-

AuthorPosts

-

15th February 2020 at 3:19 pm #91058

To the ‘I’m not paying my debts and they will go after 6 years’ group (I’ll come up with something more catchy.)

Source for the info below is from step change:

Mortgage shortfalls have a longer limitation period of twelve years for the money you borrowed (the ‘capital’), while the interest charged on this has a limitation period of six years

If the creditor has already obtained a court judgment or order before the limitation period passed the debt can never become statute-barred

Another option is don’t contact the creditor and hope that the limitation period ends before they start court action. We don’t recommend you take this approach. If a creditor hasn’t had any contact or payment from you for a long time they may start court action just before the limitation period ends. Ignoring a debt greatly increases the chances you’ll end up with a CCJ, decree or money judgment, which you may have been able to avoid by getting in touch with the creditor sooner.

No the debt stays with you for life. But the ccj doesn’t. So after the 6 years the ccj is gone. So you no longer pay the ccj. If the company wishes to they can take you to court again after the 6 years to obtain another ccj. But on credit cards loans ect this is very unlikely this will happen.. of they haven’t managed to obtain all the cash in 6 years I can’t see them doing it all over again. Citizens advice will tell you exactly the same.

So the debt stays with you for life. So what myself and sal139 are saying is not incorrect.

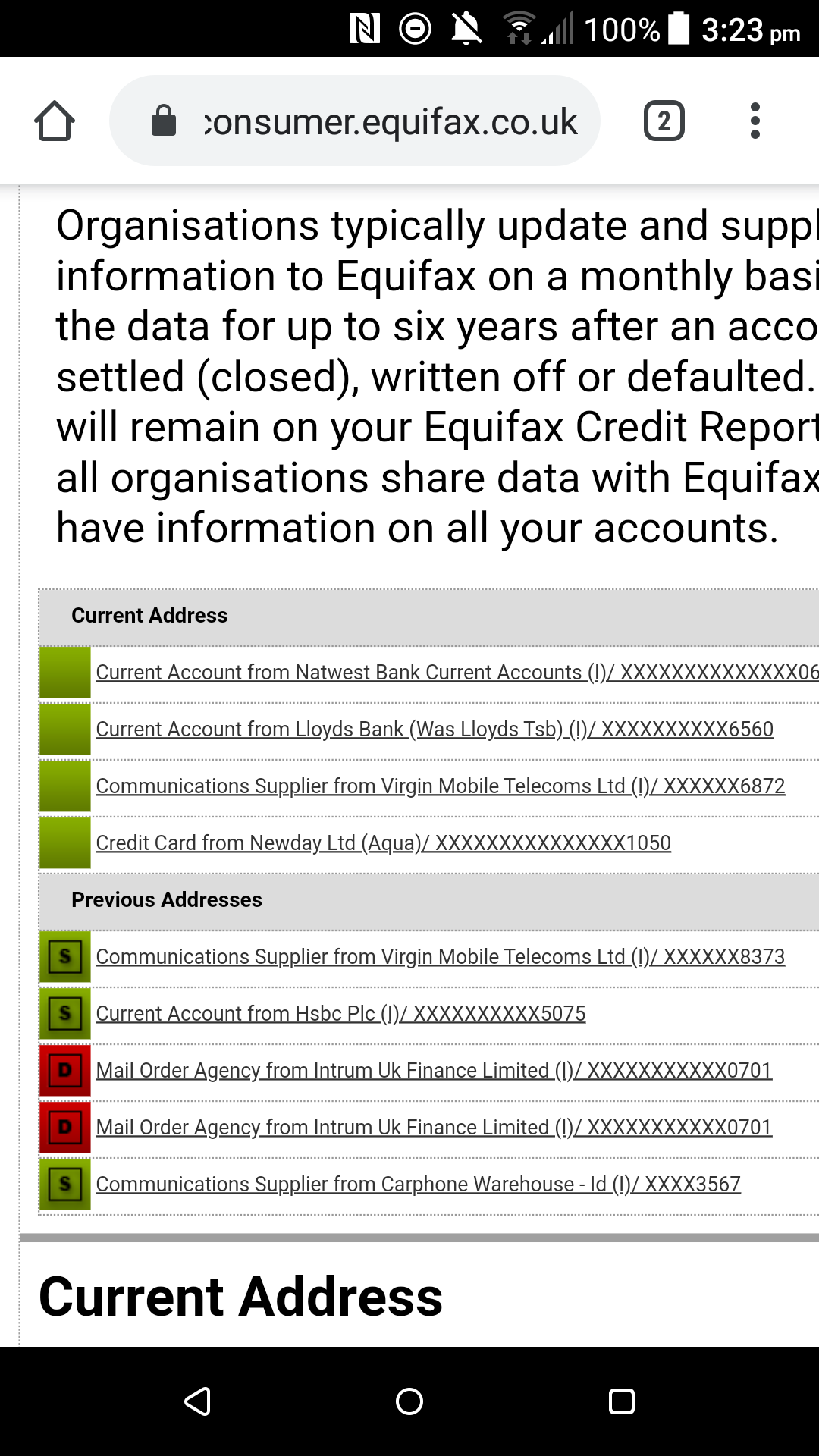

Yes it stays for life. But they won’t chase you after the ccj. Never read a story or heard Anyone who has had a ccj twice. Debt free in my opinion. My credit credit is back to normal, with £900 credit available on card and 5 ccjs waiting to drop off..

15th February 2020 at 3:25 pm #9106115th February 2020 at 3:26 pm #9106215th February 2020 at 3:27 pm #91063So what should he do lainey87 ?The loans aren’t in his name. I think he should sell his house. My mate did it after been massively in debt and behind on mortgage payments. He had literally 10% equity but says it’s the best thing he ever did even now just working part time.

15th February 2020 at 3:31 pm #91065So what should he do lainey87 ?The loans aren’t in his name. I think he should sell his house. My mate did it after been massively in debt and behind on mortgage payments. He had literally 10% equity but says it’s the best thing he ever did even now just working part time.

Same thing as if the loans were in his name.. nobody pays. Set a savings pot up and if someone does come for the money decide if you want to pay them out the savings pot.. it’s much easier than you think.. I was in a right mess. I nearly killed myself.. 6 years on I’m pretty much debt free

15th February 2020 at 3:37 pm #91070The gambling issue for me has never gone anyway. I won 7k before all this debt. And that’s what started it for me. The huge win.. I even won 2.7k a few weeks back and reversed the withdraw. But one thing I’m not is I’m not in debt anymore.. it’s dumb to mess around with credit like that. I have learned that lesson. Just can’t shake the gambling issue. Been lurking on here for ages like most people. But anyway it’s just my advice. And my advice is he goes to citizens advice and gets real advice. Not a forum

15th February 2020 at 3:37 pm #91071So what should he do lainey87 ?The loans aren’t in his name. I think he should sell his house. My mate did it after been massively in debt and behind on mortgage payments. He had literally 10% equity but says it’s the best thing he ever did even now just working part time.

Same thing as if the loans were in his name.. nobody pays. Set a savings pot up and if someone does come for the money decide if you want to pay them out the savings pot.. it’s much easier than you think.. I was in a right mess. I nearly killed myself.. 6 years on I’m pretty much debt free

You’re a stupid cunt. An astoundingly stupid fucking Cunt.

15th February 2020 at 3:38 pm #91072So what should he do lainey87 ?The loans aren’t in his name. I think he should sell his house. My mate did it after been massively in debt and behind on mortgage payments. He had literally 10% equity but says it’s the best thing he ever did even now just working part time.

Same thing as if the loans were in his name.. nobody pays. Set a savings pot up and if someone does come for the money decide if you want to pay them out the savings pot.. it’s much easier than you think.. I was in a right mess. I nearly killed myself.. 6 years on I’m pretty much debt free

You’re a stupid cunt. An astoundingly stupid fucking Cunt.

That’s why your in debt and I’m not ?

15th February 2020 at 3:40 pm #91073@lainey87 I don’t think you realise just how bad the advice is that you’re giving.

Like, astonishingly awful.

1115th February 2020 at 3:42 pm #91074@lainey87 I don’t think you realise just how bad the advice is that you’re giving.

Like, astonishingly awful.

Same advice citizens advice would give you. None priority debts come last…

15th February 2020 at 3:43 pm #91075So what should he do lainey87 ?The loans aren’t in his name. I think he should sell his house. My mate did it after been massively in debt and behind on mortgage payments. He had literally 10% equity but says it’s the best thing he ever did even now just working part time.

Same thing as if the loans were in his name.. nobody pays. Set a savings pot up and if someone does come for the money decide if you want to pay them out the savings pot.. it’s much easier than you think.. I was in a right mess. I nearly killed myself.. 6 years on I’m pretty much debt free

You’re a stupid cunt. An astoundingly stupid fucking Cunt.

That’s why your in debt and I’m not

I don’t have a single penny of debt you fucking clown, I actually pay what I owe.

15th February 2020 at 3:45 pm #91076So what should he do lainey87 ?The loans aren’t in his name. I think he should sell his house. My mate did it after been massively in debt and behind on mortgage payments. He had literally 10% equity but says it’s the best thing he ever did even now just working part time.

Same thing as if the loans were in his name.. nobody pays. Set a savings pot up and if someone does come for the money decide if you want to pay them out the savings pot.. it’s much easier than you think.. I was in a right mess. I nearly killed myself.. 6 years on I’m pretty much debt free

You’re a stupid cunt. An astoundingly stupid fucking Cunt.

That’s why your in debt and I’m not

I don’t have a single penny of debt you fucking clown, I actually pay what I owe.

Wow your angry today? Maybe u need to lay off gambling for a while or release some tension with your wife ?

15th February 2020 at 3:47 pm #91077There are a few morons kicking about on this forum, but you win the prize.

1115th February 2020 at 3:48 pm #9107815th February 2020 at 3:53 pm #91079you win the prizeFor today

This fucker will take some beating… I’ve never seen such bad advice in my life.

-

AuthorPosts

The topic ‘Where can an ex-gambler borrow money when its urgent?!’ is closed to new replies.